Israeli EV startup REE Automotive is next to go public via a Special Purpose Acquisition Company (SPAC) merger.

The company will be listed in NASDAQ under the symbol “REE” post the merger, which should complete by the end of H1 2021. REE Automotive is currently valued at $3.6 Billion.

Through this SPAC merger, REE automotive will be able to generate $500 Million. Specifically, $200 Million in cash and $300 Million from the Private Investment in Public Equity (PIPE) deal. Notable investors include US-based Koch Strategic Platforms, India-based Mahindra & Mahindra, and the Canada-based Magna International.

SPAC is a reverse-merger model, wherein an entity with no commercial operations is formed strictly to raise capital from the stock market through IPO to acquire an existing company. In this case, the SPAC is 10X Capital Venture Acquisition Corporation.

10X Capital’s stock recently hit the market and is currently trading at $14.70 apiece. The shareholders of 10X capital will hold 5.6% of REE once the merger is approved. In contrast, a classic IPO can take 1 to 2 years to hit the market due to regulatory checks. Hence, SPAC deals are gaining momentum, especially for EV startups.

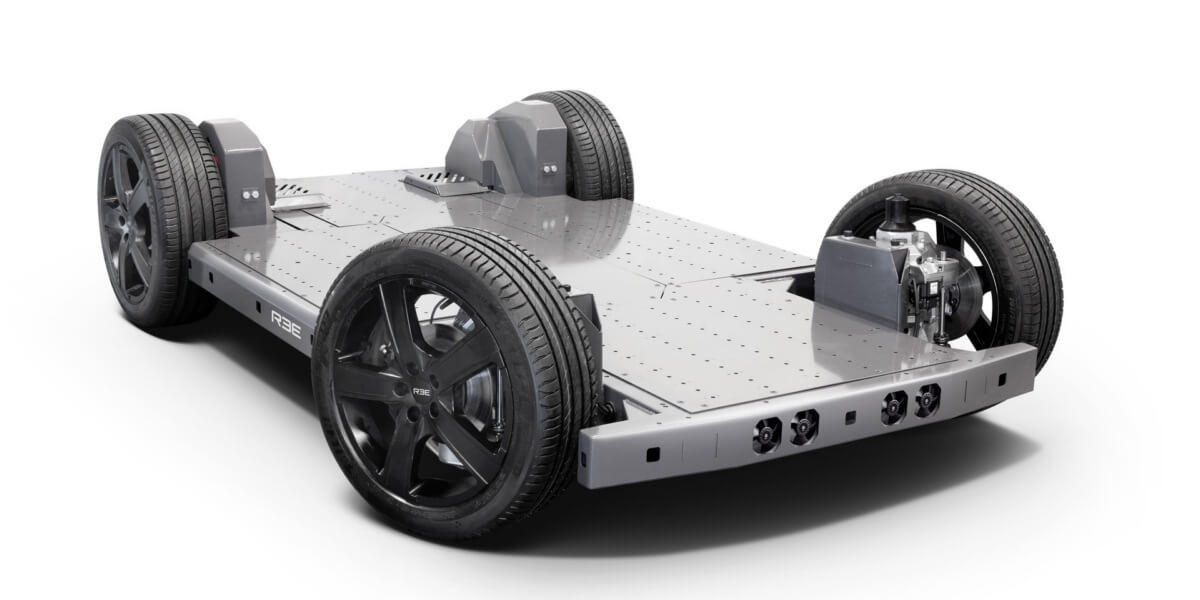

Started in 2013, REE focuses on making EVs and autonomous vehicles for current and future applications, including last-mile delivery, Mobility-as-a-service (MaaS) with EV shuttles, EV logistics, and Robo taxis. The X-by-Wire architecture enables the creation of a modular and scalable platform, called the REEboard.

REE’s platform variants include the P1 AD for last-mile delivery, the P2 for American Class1 vehicles, and the P4 for payloads up to 4-5 tons. Meanwhile, the P6 and P7 platform variants provide a payload capacity of 6 to 7 tons.

Interestingly, REE also uses brake-by-wire and steer-by-wire technologies and preventive maintenance AI. Furthermore, the ‘REEcorners’ platform encompasses the powertrain, drivetrain, steering, and suspension into the vehicle’s corners, fitting right into the wheels, thus allowing for more battery space.

REE automotive’s mass production should start in 2023, while the company is expected to become profitable from 2024. REE’s strengths lie in the REEcorner and REEboard technologies, which can scale and serve Class 1 to Class 6 type vehicles as per American standards.