Is the EV honeymoon over? Nearly half of American electric vehicle owners are contemplating a return to traditional gas-powered cars due to charging woes and high costs.

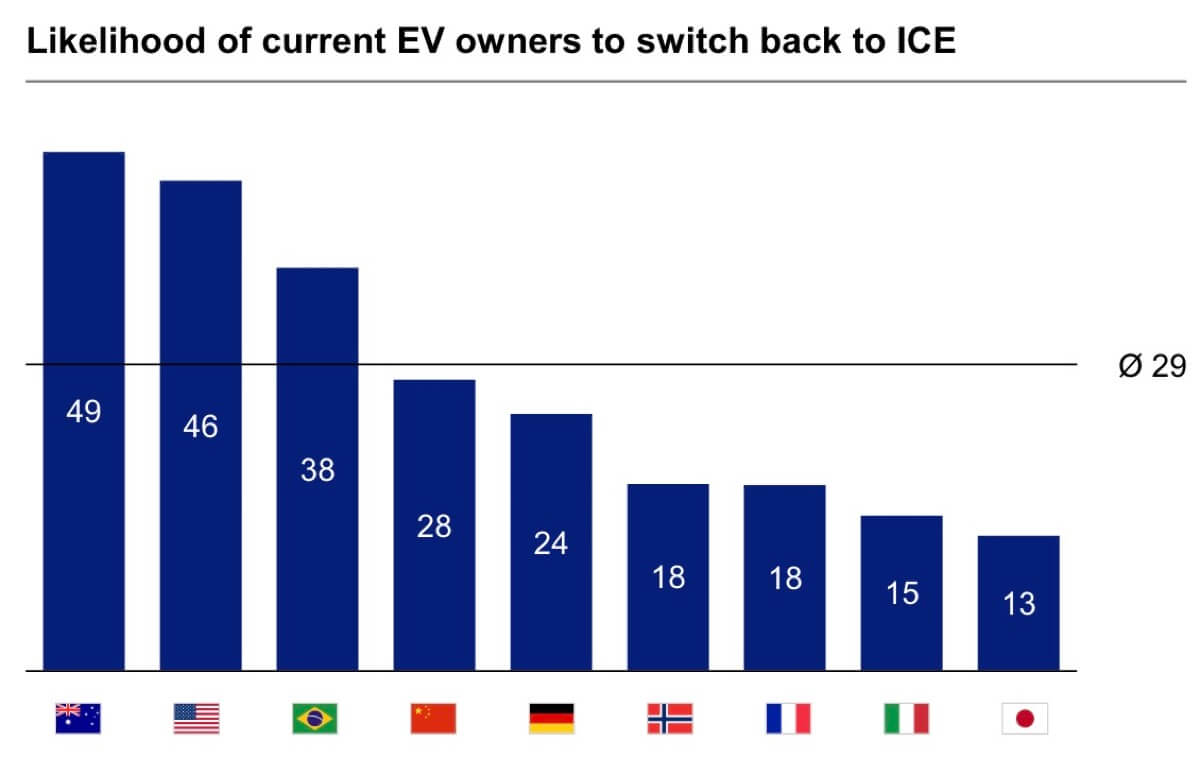

Electric vehicle (EV) ownership in the U.S. is facing some unexpected turbulence. According to a new study by McKinsey & Co., a surprising 46% of American EV owners are likely to switch back to internal combustion engine (ICE) vehicles for their next purchase. This revelation comes from the McKinsey Mobility Consumer Pulse study, which surveyed over 30,000 respondents globally on their mobility preferences and experiences.

Globally, the study found that 29% of EV owners are considering a return to ICE vehicles. The reasons behind this shift are varied, but the most prominent issue is the inadequate public charging infrastructure. In fact, 35% of global respondents cited charging difficulties as their main concern. This was followed by the high total cost of ownership (34%) and the impact on driving patterns during long road trips (32%).

The study also highlighted that only 9% of respondents are satisfied with the expansion of the public charging network in their regions. This dissatisfaction is particularly pronounced in the U.S., where the slow rollout of the National Electric Vehicle Infrastructure program has left many EV owners frustrated.

Dr. Philipp Kampshoff, leader of McKinsey’s Center for Future Mobility, expressed concern that the situation might worsen as the next generation of EV buyers will rely more on public charging than current owners do.

Despite these challenges, the interest in EVs is still growing, albeit slowly. The survey found that 18% of current non-EV owners in six countries, including the U.S., plan to purchase a battery electric vehicle (BEV) for their next car. This is an increase from 16% in 2022 and 14% in 2021. Additionally, 20% expressed interest in plug-in hybrid EVs (PHEVs).

However, the enthusiasm for EVs is tempered by practical concerns. The study revealed that 21% of participants have no intention of switching to an EV, a figure that has remained steady since 2022. The primary reasons for this reluctance are the high cost of EVs (45%), charging concerns (33%), and range anxiety (29%).

Interestingly, the study noted that luxury vehicle owners show nearly double the interest in EVs compared to those who drive entry-level cars. It also found that potential EV buyers tend to be younger, more tech-savvy, have higher disposable incomes, and live in urban areas where they can charge their vehicles at home.

The study also highlighted a growing expectation for EV range. In 2022, consumers expected a minimum range of 270 miles, but this has increased to 291.4 miles in 2024. This expectation outpaces actual improvements in EV range, which have only increased by 2% over the same period.

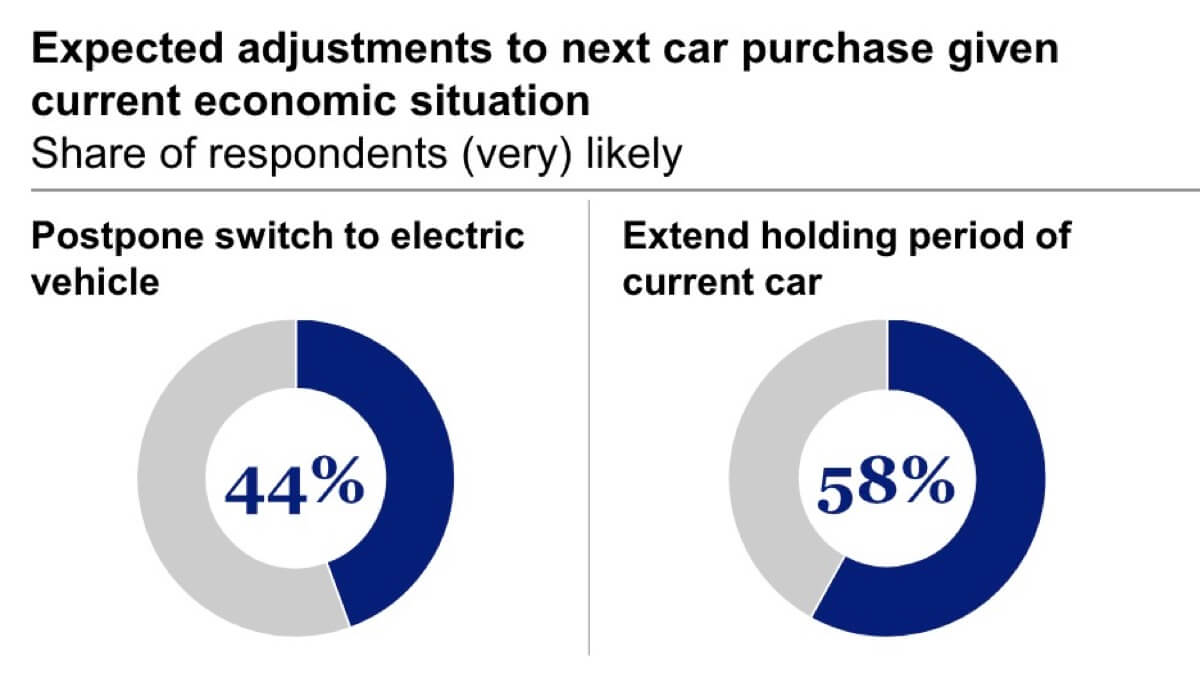

Economic factors are also playing a role in the decision to postpone EV purchases. The current economic situation, marked by higher interest rates and uncertainty, is causing many consumers to hold onto their cars—whether EV or ICE—much longer. The average age of American cars is now 14 years.

The McKinsey study underscores the need for the automotive industry and government to work together to address these challenges. Improved charging infrastructure, better range, and more affordable EVs are crucial for wider adoption. As automakers continue to innovate, there is hope that the next generation of EVs will better meet consumer expectations and overcome the current barriers to adoption.