Donald Trump brings oil and gas back to center stage while putting electric vehicles on the chopping block.

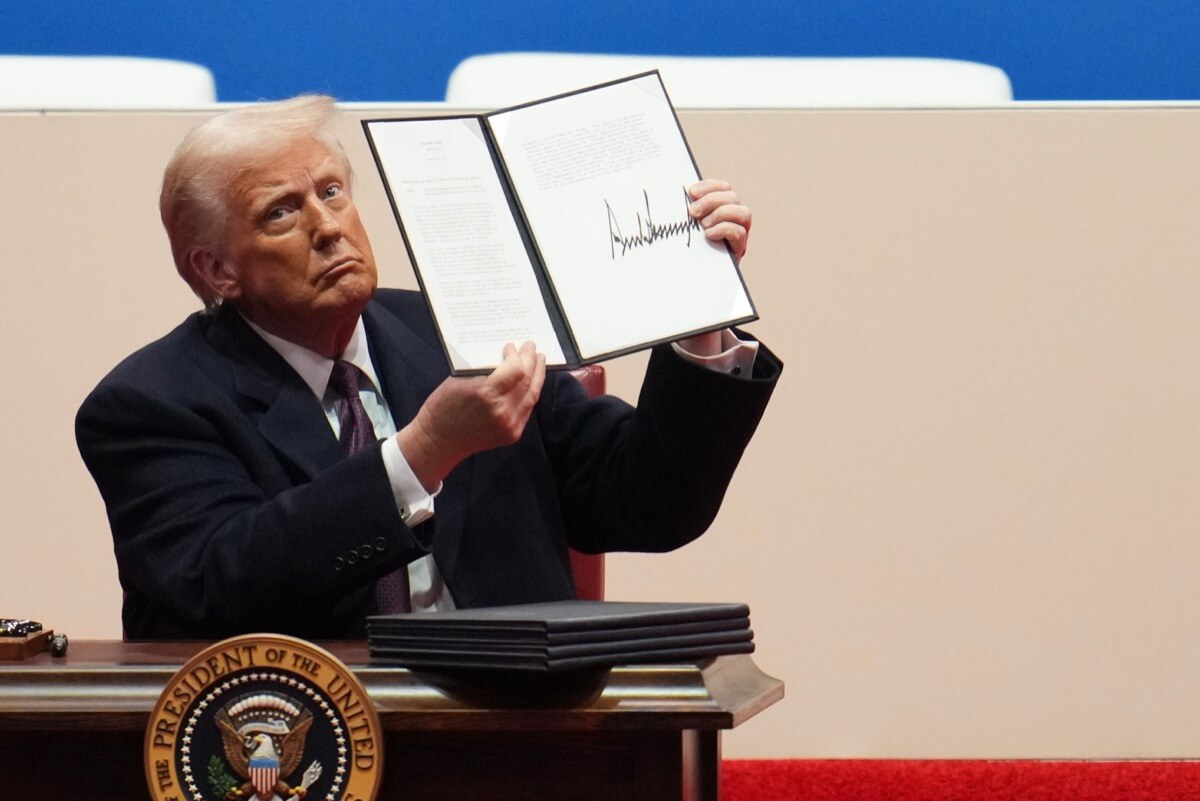

Donald Trump is back in the White House, and he’s wasting no time making big changes, especially when it comes to energy and electric vehicles (EVs). On his first day, he declared a national energy emergency and signed several executive orders to boost domestic oil and gas production. Trump is also taking aim at EVs and clean energy policies introduced by his predecessor, Joe Biden, calling them “mandates” that unfairly push electric cars onto Americans.

One of Trump’s key actions was revoking Biden’s non-binding goal of making 50% of new cars sold in the U.S. electric by 2030. While many automakers had supported this target, Trump dismissed it as a “mandate” and claimed it was sabotaging U.S. industries while countries like China “pollute with impunity.” He also hinted that the $7,500 federal EV tax credit could be scrapped, though no final decision has been announced yet.

The president’s orders also pause funding for EV charging infrastructure. Biden had set aside $7.5 billion to build a nationwide network of chargers, aiming for 500,000 by 2030. Trump’s new policy puts a freeze on those funds, signaling a shift away from support for EVs. This move is part of his broader push to promote fossil fuels and reduce regulations on oil and gas production. Trump has promised to reopen drilling in Alaska and review restrictions on offshore drilling.

Energy prices and inflation are central to Trump’s agenda. He blames rising costs on what he calls Biden’s “massive overspending” and policies that favor clean energy. By increasing oil and gas production, Trump hopes to bring down prices at the pump and cut costs across the board for American consumers. During his inauguration speech, he doubled down on his slogan, saying it’s time to “drill, baby, drill.”

Critics argue that these rollbacks could harm the environment and slow the transition to cleaner energy. Environmental groups have pointed out that EVs are gaining popularity because they help reduce greenhouse gas emissions and offer lower running costs. Meanwhile, Trump’s actions have raised concerns about the future of clean energy investment and innovation in the U.S.

Energy companies, on the other hand, are poised to benefit from these changes. Experts predict that deregulation and increased domestic production will boost profits for oil and gas firms. Stocks in these sectors are expected to rise as markets adjust to Trump’s policies.

The global impact of Trump’s energy policies remains to be seen. With U.S. crude oil production already at record highs, increasing output could lead to shifts in global oil prices. Some analysts warn that this approach may create volatility in energy markets.

Trump’s decisions mark a sharp departure from the previous administration’s focus on clean energy and electric vehicles. For now, it’s clear that the new administration is betting on traditional energy sources to drive economic growth, even as the rest of the world moves toward cleaner alternatives. Whether this strategy pays off for consumers and the economy remains to be seen.